Cattle Insurance

Market Agrement on Cattle Insurance

Applicability

Applicable to indigenous, cross-bred and Exotic cattle owned by/belonging to Private owners, various financial insititutions,i.e. Bank financed, Military dairy farms, co-operative/corporate dairies, etc.

Cattle means and includes :

(a) Milch cows and buffaloes

(b) Calves/Heifers

(c) Stud bulls

(d) Bullocks/He buffaloes

(e) Mithuns

Upper insurable age shall be treated as the maximum permissible insurable age at the inception of the Policy (Annual). Kindly refer to the Circular No. HO. RID: 08/95-96 CR-4297 dated 10/04/96.

AGE GROUPS

(i) Milch cows 2 years or age at first calving to 10 years

(ii) Milch buffaloes 3 years or age at first calving to 12 years

(iii) Stud Bulls 3 years or earlier age at sexual maturity to 8 years

(iv) Bullock/He buffaloes 3 years to 12 years

(v) Calves/Heifers 4 months upto date of 1st calving.

(No relaxation in upper age - limits is allowed)

VALUATION

Valuation based on market value as on date and place and to be decided on the basis of recommendations of the local veterinary surgeon.

SUM INSURED

Not exceeding market value.

PREMIUM RATES 1.5% to 4%

(d) Transit Cover :

(i) No extra premium to be charged for transit of animal from place of purchase to place of stabling if distance is upto 80 kms.

(ii) In case of transfer of animal during currency of policy, transit cover can be extended to the new owner without any additional premium in case the transit distance is within 80 kms. (Intimation must be given to Comoany and consent taken thereof).

(iii) In case the transit is for more than 80 kms, an additional rate of 1% shall be charged. Such transit shall only be by road or rail and not on foot.

(e) Extra Rates :

(a) Exotic cattle 2% (gross)

(b) To cover PTD (Not allowed in claim-prone areas) 1% (gross)

(f) Malus :

Claim Ratio Malus

100-110 20%

111-130 33%

131-160 60%

161-200 100%

MINIMUM PREMIUM - Rs. 50/- per policy.

SCOPE OF COVER/INSURANCE COVERAGE

The policy shall give indemnity only for death of cattle due to :-

(i) Accident (Inclusive of Flood, Cyclone, Famine) or any other fortuitous circumstances (fortuitous means accidental in origin).

(ii) Diseases (Inclusive of Rinderpest, Black Quarter, Heomorrhegic Septicemia, foot and mouth disease subject to vaccination against these diseases.

(iii) Surgical Operations

(iv) Strike, Riot and Civil Commotion risk & Terrorism

(v) Earthquake

Contracted or occuring during the period of insurance subject to following Exclusions :

Death or loss due to :-

(a) Malicious or wilful act, negligence, over loading, unskilled treatment, use of the animal other than stated in the policy without the consent of the Company.

(b) Accident/diseases contracted prior to commencement of risk.

(c) Intentional slaughter of the animal except in cases where destruction is necessary to terminate incurable sufferings on human consideration on the basis of certificate issued by qualified veterinarian or in cases where destruction is resorted to by order of Lawfully constituted authority.

(d) Transport by air or sea

(e) Transit beyond 80 KMS, by road or rail, (can be covered if the transit is within the state by charging additional premium of 1%)

(f) Pleouropneumonia in Lakimpur and Sibsagar District of Assam

(g) Theft of clandestine sales, missing of insured animal

(h) Partial disablement of any type, whether permanent or temporary

(i) Permanent total disablement which in case of Milch cattle results in permanent and total incapacity to conceive or yield milk, in case of Bullocks and castrated male buffaloes results in permanent and total incapacity for the purpose of use mentioned in the proposal

(j) War and Allied perils

(k) Nuclear exclusion clause

(l) Consequential loss of whatsoever nature

(m) Death of the animal due to diseases within 15 days from the inception of the policy

(n) ‘No tag - No claim’ is applicable here.

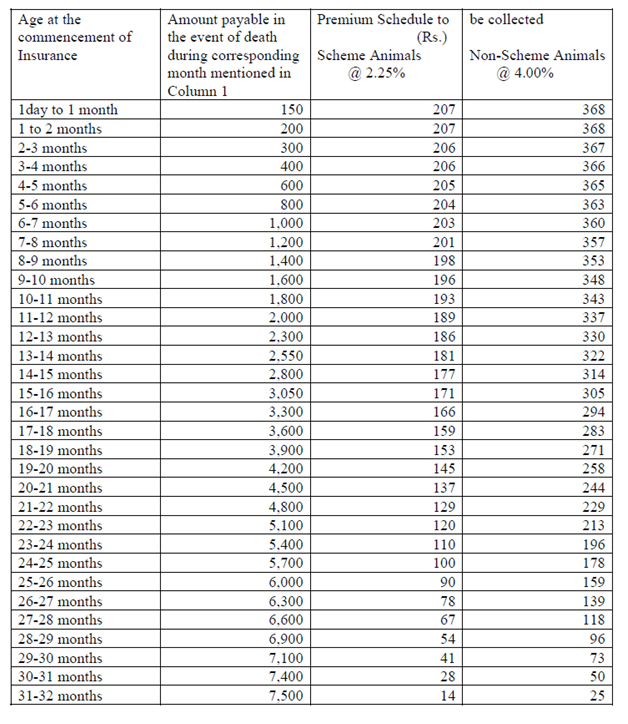

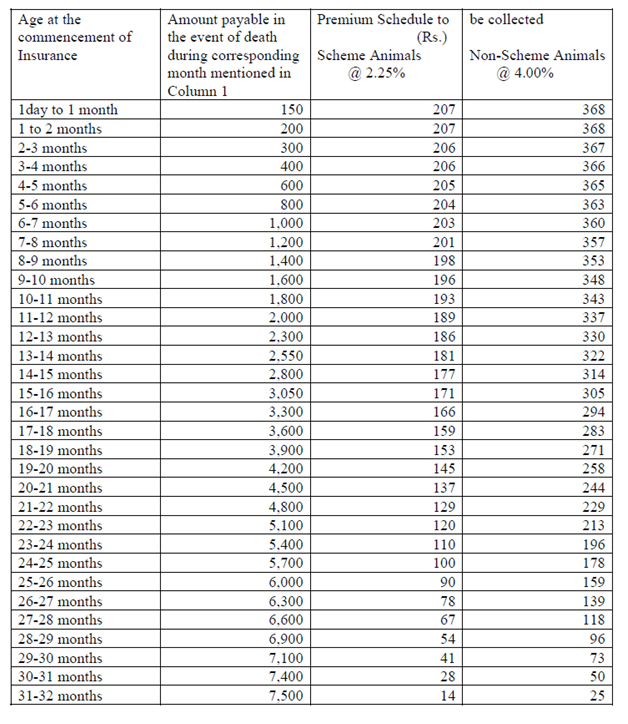

HEIFER REARING INSURANCE SCHEME FOR SCHEME/NON-SCHEME BENEFICIARIES

1. The Companies may implement this Scheme with caution and separate statistics may be maintained for review of the Scheme.

2. The Sum Insured is only indicative and depending on local market conditions, it can be altered. Proportionate premium amount may be charged using the method given below.

3. The minimum period of coverage should not be less than 12 months.

4. In case of Non-Scheme animals, the premium rate would be @ of 4% and accordingly, the premium amount should be computed. The premium rate for Scheme animals would be @ 2.25%.

5. The premium amount is computed from 1 day to 32 months.

For example : In respect of Scheme animals, the premium is Rs. 207.00 for 32 months and in respect of Non-Scheme animals, the premium is Rs.368.00 for 32 months (Valuation Table enclosed).

6. The formula adopted for calculation of premium is as under :-

Scheme Animals Non-Scheme Animals

Add : The aggregate sum = Rs. 1,10,450.00 and 1,10,450.00 insured from 1 day to 32 months

Average Sum Insured = Rs. 3,451.60 and 3,451.60 for 32 months . or 3,452.00 3,452.00

Apply premium rate = Rs. 3,452 X 2.25 3,452 X 4.00on average amount Rs. 77.66 138.08

Average for One month= Rs. 77.76/12 138.08/12= Rs. 6.47 11.50

Premium for 32 months= Rs. 6.47 X 32 11.50 X 32 = Rs. 207.00 3.68.00

If the cover is given from 6 months onwards, the sum insured for earlier months is excluded from aggregate sum insured while calculating the premium.

7. The scope of cover and exclusions are as per Standard Cattle Insurance Policy.

8. The Claim procedure will be same as under Cattle Insurance Policy.

As far as Buffalo Calves are concerned, there is an existing Scheme and no changes have been made.

CALF REARING SCHEME VALUATION CHART FROM 1 TO 32 MONTHS

Source: http://www.orientalinsurance.org.in |