|

1. Kisan Credit Card

2. For Strengthening Transfer of Technology and Extension Services in Field of Agriculture

3. Minor Irrigation Loans

4. Farm Machinery Loans

5. Farm Development Loans

6. Vehicle Loan for Agriculturists

7. Loan for Plantation Crops

8. Loan for Marine Fisheries

9. Loan for Inland Fisheries

10. Loan for Sericulture

11. Loans for purchasing Agricultural Land

12. Loan for Poultry and Duck Rearing

13. Export Credit

14. Produce Loan

15. Loan for Cold Storage and Rural Godown

16. Drip / Sprinkler Irrigation Loans

17. Dairy Loan and Raising Crossbreed Heifrs

18. Loans for Construction of Farm Houses

19. Kisan Suvidha

20. Canara Kisan OD

21. General Credit Card Scheme (GCCS)

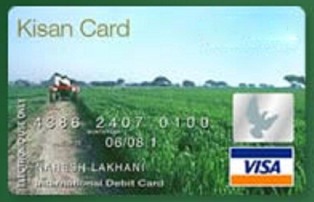

1. Kisan Credit Card

Top

Canara Bank is the pioneer in implementing Credit Card Scheme for farmers.

| Purpose |

For meeting the cultivation needs of farmers and other short term requirements including those of subsidiary / allied activities and consumption needs. |

| Eligibility |

Individual farmers / joint borrowers / partnership firms/ private & public Ltd. companies who are owner cultivators / engaged in allied / subsidiary activities.

Farmers who are cultivating authorized leased lands are also eligible. The farmer should not be a defaulter of any Financial Institution. |

| Margin |

For limits Upto Rs. 25,000 Nil

For limits Above Rs. 25,000 15-25% or as per Scale of Finance. |

2. For Strengthening Transfer of Technology and Extension Services in field of Agriculture

Top

| Purpose |

For providing expert services and advice to farmers on cropping practices, technology dissemination, crop protection from pests and diseases, market trends and prices of various crops in the market, clinical services for animal health. |

| Eligibility |

Graduates in Agriculture / Horticulture / Animal Husbandry / Forestry / Dairy / Veterinary / Poultry Farming / Pisciculture-Individuals / Joint / Firms / limited companies. |

| Limit |

For individuals : Rs.10 lacs

For groups / partnership firms : Rs.50 lacs |

3. Minor Irrigation / Pumpset Loans

Top

Purpose |

For purchase of electrical motors, oil engines, submersible irrigation pumpsets, for energisation of agricultural pumpsets, pipelines including installation charges, installing generator sets, solar pumpsets, installation of drip ./ sprinkler irrigation systems, fertilizer mixers. |

| Eligibility |

Owner cultivators with minimum 2 acres of land. Loans can be considered for less than 2 acres area provided, viability of the project is ensured. |

| Limit |

- Upto Rs.25,000 : Nil

- Above Rs.25,000 : 15-25%

|

4. Farm Machinery Loans

Top

For Strengthening Transfer of Technology and Extension Services in field of Agriculture

| Purpose |

For purchase of tractors, power tillers, trailers, combine harvester, grain threshers, sprayers, dusters, ploughs, drills, mechanical weeders or any other modern agricultural machinery. |

| Eligibility |

Farmers who satisfy the Bank's norms. |

| Margin |

- Upto Rs.25,000 : Nil

- Above Rs.25,000 : 15-25%

|

5. Farm Development Loans

Top

Purpose |

For digging / deepening of wells, construction of tanks, ponds, drilling of bore wells, soil and water conservation watershed development bundling land reclamation, leveling of land, terracing, conversion of dry land into wet, irrigable lands, fencing, construction of farm houses and other allied activities. |

| Eligibility |

Farmer should be owner of the land |

| Margin |

- Upto Rs.25,000/- : Nil

- Above Rs.25,000/- : 15-25%

|

6. Vehicle Loan for Agriculturists

Top

Purpose |

For purchase of brand new vehicles such as bicycles, mopeds, two wheeler / three wheeler carriages, jeeps, cards, vans and other light motor vehicles for supervising agricultural operation / management of farm / estate and for transportation of agricultural produce / inputs, vehicles may also be considered.

Purchase of heavy vehicles such as lorries for big farmers owning at least 15 acres of perennially irrigated land. |

| Eligibility |

Agricultural cultivating in his own land or engaged in allied activities such as dairy, poultry, sericulture, fish farming, etc. |

| Margin |

15 - 25% of the cost of the vehicle. |

7. Loan for Plantation Crops

Top

| Purpose |

For establishment of estates, clearing of jungle, conversion of barren land into cultivable land, purchase of planting material, rejuvenation / replanting. |

| Eligibility |

Owners of the land who have experience / knowledge in the proposed activity. |

| Margin |

- Upto Rs.25,000 : Nil

- Above Rs.25,000 : 15-25%

|

8. Loan for Marine Fisheries

Top

| Marine Fisheries |

Purchase / construction of mechanized fishing vessels, fishing equipments, working capital requirement for voyages |

| Eligibility |

Professional fishermen. |

| Margin |

- Upto Rs.25,000 : Nil

- Above Rs.25,000 : 15-25%

|

9. Loan for Inland Fisheries

Top

| Inland Fisheries |

Construction / deepening / widening / desilting of ponds, purchase of fingerlings, equipments, manures, feeds and labour inputs. |

| Eligibility |

Well experienced fish farmers with suitable land, professional fishermen |

| Margin |

Upto Rs.25,000 : Nil

Above Rs.25,000 : 15-25% |

10. Loan for Sericulture

Top

| Purpose |

For cultivation of mulberry, rearing of silk worms, construction of rearing house, purchase of rearing equipments / wire mesh / disease free layings (DFL). |

| Eligibility |

License / permission from Sericulture Department for rearing silkworms in the area, wherever required.

Technical assistance from Sericulture Department or any other organization dealing with sericulture development should be available on continuous basis. |

| Margin |

For limits upto Rs.25,000/- : Nil

For limits above Rs.25,000/- : 15-25% |

11. Loan for Purchasing Agricultural Land

Top

| Purpose |

To purchase, develop and cultivate agriculture as well as fallow and waste lands. |

| Eligibility |

Small & Marginal farmers / Share Croppers / Tenant farmers satisfying certain norms related to total land holding. |

| Margin |

Minimum 20% |

12. Loans for Poultry and Duck rearing

Top

| Purpose |

For establishing / improving layer / broiler farms and hatcheries including purchase of chicks, feeds, medicines, equipments, feed mixing plants, construction of poultry sheds, also for rearing Ducks / Turkeys / Qualis. |

| Eligibility |

Person having experience / knowledge in poultry. |

| Margin |

Minimum 20% |

13. Export Credit

Top

| Purpose |

For purchase/processing/manufacturing/packing of agro products for exports including purchase of fertilizers, pesticides, other inputs, post harvest expenses for making shipment. |

| Eligibility |

Export Oriented Units (EOUs) having expertise/technical know-how and having Firm Orders/Contracts/LCs. |

14. Produce Loan

Top

| Purpose |

To keep the produce in an approved godown or warehouse or in farmers’ residence enabling them to sell the produce for a better price of a later date. |

| Eligibility |

1. Farmers who have availed Crop Loan /KCC.

2. Farmers who have not availed Crop Loan /KCC. |

| Maximum Limit |

Rs.10 lacs per party |

| Repayment |

Within 12 months from the date of grant |

15. Loan for Cold Storage and Rural Godown

Top

Purpose |

1. For creation of scientific storage capacity with allied facilities to store farm produce, processed farm produce and agricultural inputs.

2. Promotion of grading, standardization and quality control of agricultural produce prevention of distress sale, strengthen agriculture marketing infrastructure. |

| Eligibility |

Individuals / farmers, group of farmers / growers, partnership / proprietary firms, NGO’s SHG’s, Companies, Corporations, Co-operatives, Agro-Processing Co-operative Societies., Agricultural Produce Marketing Committees, Marketing Board and Agro Processing Corporations, Grower’s Associations. |

16. Drip / Sprinkler Irrigation Loans

Top

| Purpose |

For purchase of drippers, pressure regulators, filters, pipes, accessories, fertilizer mixers and pumpsets. Construction of overhead tanks and installation of sprinkler irrigation units. Purchase of water saving devices / modern irrigation equipments. |

| Eligibility |

Owners of land. Tenant cultivators can also be considered. |

17. Dairy Loan and Raising Crossbreed Heifrs

Top

Purpose

|

1. For construction of cattle shed, purchase of high yielding milch cattle, dairy equipments, cattle feed, cultivation of green fodder, transportation of animal, setting of on-farm processing and pasteurization plants.

2. Purchase / rearing of cross breed heifers. |

| Eligibility |

1. Farmer should have experience / knowledge in maintaining dairy animals

2. Veterinary facilities readily and easily available.

3. Should be cultivating or having arrangements for supply of green fodder.

4. Availability of technical assistance / guidance artificial insemination facilities. |

18. Loans for Construction of Farm Houses

Top

| Purpose |

Construction of farm houses including storage rooms / godowns / sheds for livestock and farm machinery. |

| Eligibility |

Farmer shall be the owner of the land. Should be economic land holdings having sufficient surplus income from agriculture to repay the loan. |

19. Kisan Suvidha

Top

Purpose |

For meeting the comprehensive credit needs of farmers.

Working capital requirements: for crop cultivation expenses, working capital requirements for allied activities, maintenance of farm machinery/ equipments, non-farm sector activities and consumption needs.

Term loans requirements like purchase of agricultural implements, land development, purchase of bullocks and carts, purchase of farm machinery, minor irrigation. |

| Eligibility |

Agriculturists can avail finance for working capital requirements either under KCCS (Kisan credit Card Scheme) or under Kisan Suvidha scheme and not under both the schemes. |

20. Canara Kisan OD

Top

Purpose |

To provide a hassle-free overdraft facility for working capital expenses of agriculturists to be incurred for allied activities, repairs and replacements of farm machinery, working capital requirements or/and for non-farm sector activities and consumption needs, subject to ceiling for each type of expense.

The account can also be operated by ATM card (if facility is available in the branch) or cheque leaves. |

| Eligibility |

Agriculturists having satisfactory repayment record for the past 1 year.

The Scheme is operational only in select branches of the Bank. |

21. General Credit Card Scheme (GCCS)

Top

Objective |

-

General Credit Card Scheme has been introduced as an important measure in the area of Financial Inclusion.

-

To provide hassle free credit to Rural and Semi-urban households without insistence on security, purpose or end use of the credit.

|

| Purpose |

- Loan can be sanctioned for any general purpose including that of consumption.

|

| Eligibility Norms |

|

| Loan Quantum |

|

| Margin |

- No margin shall be insisted

|

| Tenability |

Limit extended is of overdraft nature tenable for three years |

| Security |

No security is insisted. No co-obligation / third party guarantee |

For further details Click here

Source: http://www.canarabank.com |